The Challenge

In the dynamic landscape of autonomous driving, sensors play a pivotal role in shaping the safety and reliability of self-driving/driver-assistance systems. Unfortunately, each existing sensor type comes with its own set of limitations. High-resolution cameras, though inexpensive, struggle in adverse weather and high-contrast light conditions. Laser-based rangefinding LiDARs can have exceptional resolution but face serious challenges of high cost and susceptibility to bad weather. Radars, conversely, perform very well in adverse weather but have poor resolution and are subject to ghosts/phantoms. Conventional radars may not know which objects are real and which are false, and sometimes critically miss real objects as a consequence (source references in prospectus).

To compensate for the weaknesses of each sensor, data fusion is performed by the artificial intelligence (A.I.) control system. Sensor fusion analyzes the data of all the sensors to correlate good data between different sensors and to eliminate bad data. However, sensor fusion can be fooled if the input contains too much bad data. Essentially, the situation can become "garbage in = garbage out" (source references in prospectus).

The quest for better sensor data led AWEARE to pursue signal processing methods that combine the strengths of LiDARs and radars. This allows for sensors with the cost-effectiveness and all-weather suitability of radar but matching LiDAR's resolut ion. The breakthrough was first demonstrated in 2016 with a laboratory prototype that improved range/velocity resolution by more than 4X and eliminated more than 95% of false positives.

After years of cost reduction, the technology was implemented in 2023 into prototypes maintaining most of this performance but using low-cost automotive-grade components. Independent radar experts have recently verified that AWEARE's low-cost prototype exceeds range/velocity resolution by 2x to 3x and eliminates 80%+ of false positives compared to traditional automotive (FMCW) radar.

A message from our Founder

Mark Hyman

Mark is a veteran CIO and software architect with decades of experience leading wireless sensor, communication, and embedded system programs. Known for delivering secure SaaS and encrypted solutions, he has managed complex antenna controls, industrial automation, and healthcare analytics. Holding an M.S. in Computer Science, he specializes in AI-driven control systems and real-time processing for innovative industries.

Daniel Hyman

Dr. Hyman is the visionary behind DRONEKILLER®, leveraging expertise in radio-frequency electronics, hardware development, and scientific analysis. Renowned for strategic patent generation and licensing, he fosters collaborative environments uniting technical and business goals. With a strong track record of commercializing innovations and delivering investor returns, he holds over 20 patents and has published more than 100 papers and articles.

Patent portfolio

Mahesh Reddy

Mr. Reddy is a seasoned advisor with over 30 years of aerospace experience at Rockwell Collins, B/E Aerospace, and Boeing, overseeing complex product life cycles from design through delivery. Known for leading multi-billion-dollar operations, he excels in program management, strategic development, and turnaround solutions. Holding four US patents, he fosters collaborative teams, ensuring efficient market entry for new technologies.

Leveraging compatibility with existing chipsets, AWEARE algorithms and technologies can be quickly implemented for high volume markets, particularly automotive. This is central to gaining first mover advantage while allowing partners and customers to capitalise on performance and reliability advantages under an attractive licensing model. As the overall industry grapples with setbacks, breakthroughs like these pioneered by AWEARE underscore the dynamic nature of this industry. Innovative sensor solutions hold the key to realising the transformative potential of autonomous vehicles.

With continued execution and scheduled milestones, AWEARE may be in a favourable position to launch market-specific ventures to accelerate adoption. As the industry evolves and the technology gains wider traction, there is substantial room for rapid growth beyond these conservative assumptions.

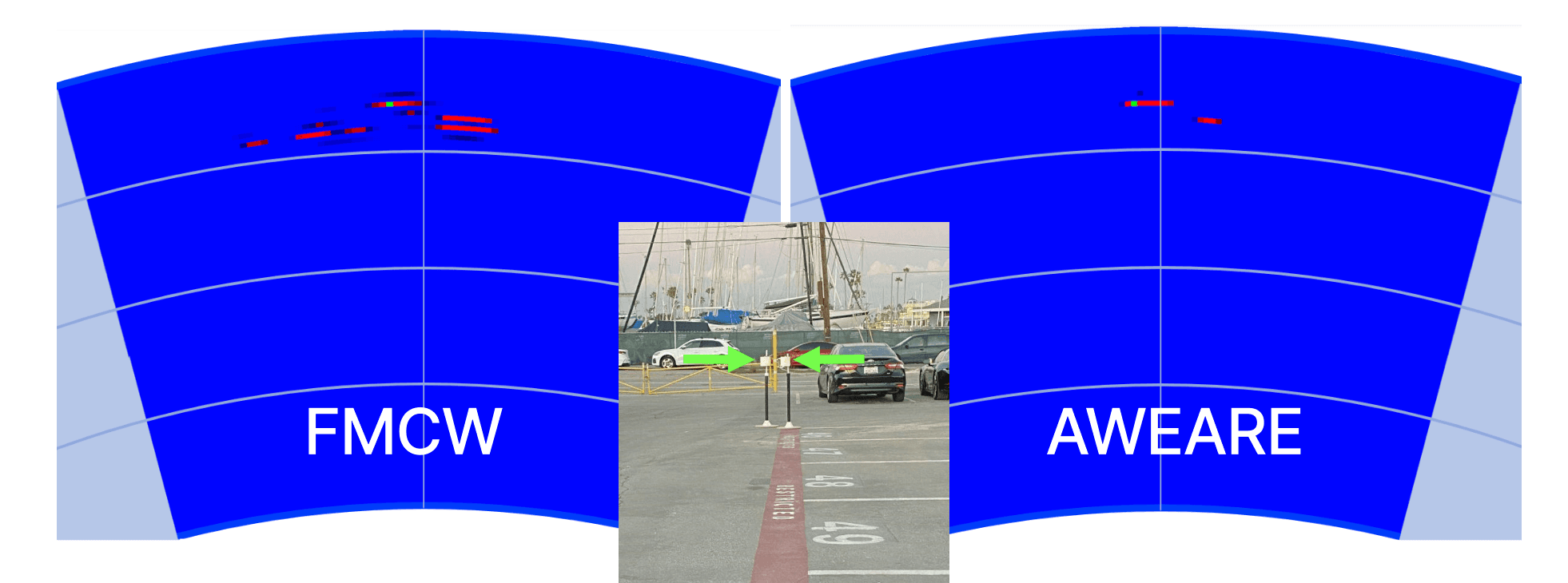

Without AWEARE

Conventional radar viewing two "smudged" radar targets also sees numerous ghosts

With AWEARE

AWEARE eliminates most of the ghosts while clarifying the location of the radar target.

More accurate and reliable radar technology can be inserted in automotive, trucking, light rail, high speed rail, security, robotics, law enforcement, and numerous other applications. Designed for compatibility with existing chipsets from leading suppliers, the cost of implementation is drastically reduced while shortening time to market. The financial projections for AWEARE Global are strictly focused on discounted revenues in the automotive and light rail sectors. This conservative approach does not count (at all) the majority of potential applications such as trucking and industrial robotics.

By offering breakthrough capabilities at aggressive licensing terms of less than 1/3 industry norms, AWEARE aims to rapidly gain market share. Within the automotive sector, technology adoption occurs through existing channels, so the revenue model is focused on licensing to Tier 1 system and Tier 2 chipset suppliers. The software licensing model leverages existing supply chains and assumes AWEARE will receive 1% of radar product revenue with a low cost of sales. It should be highlighted that a 1% license fee is deliberately low, considering that automotive industry IP licensing averages 3.3% of revenues and electronics licensing is typically 5.1% (source references in prospectus). The projections assume that the aggressive penetrating price strategy will continue even after gaining substantive industry traction.

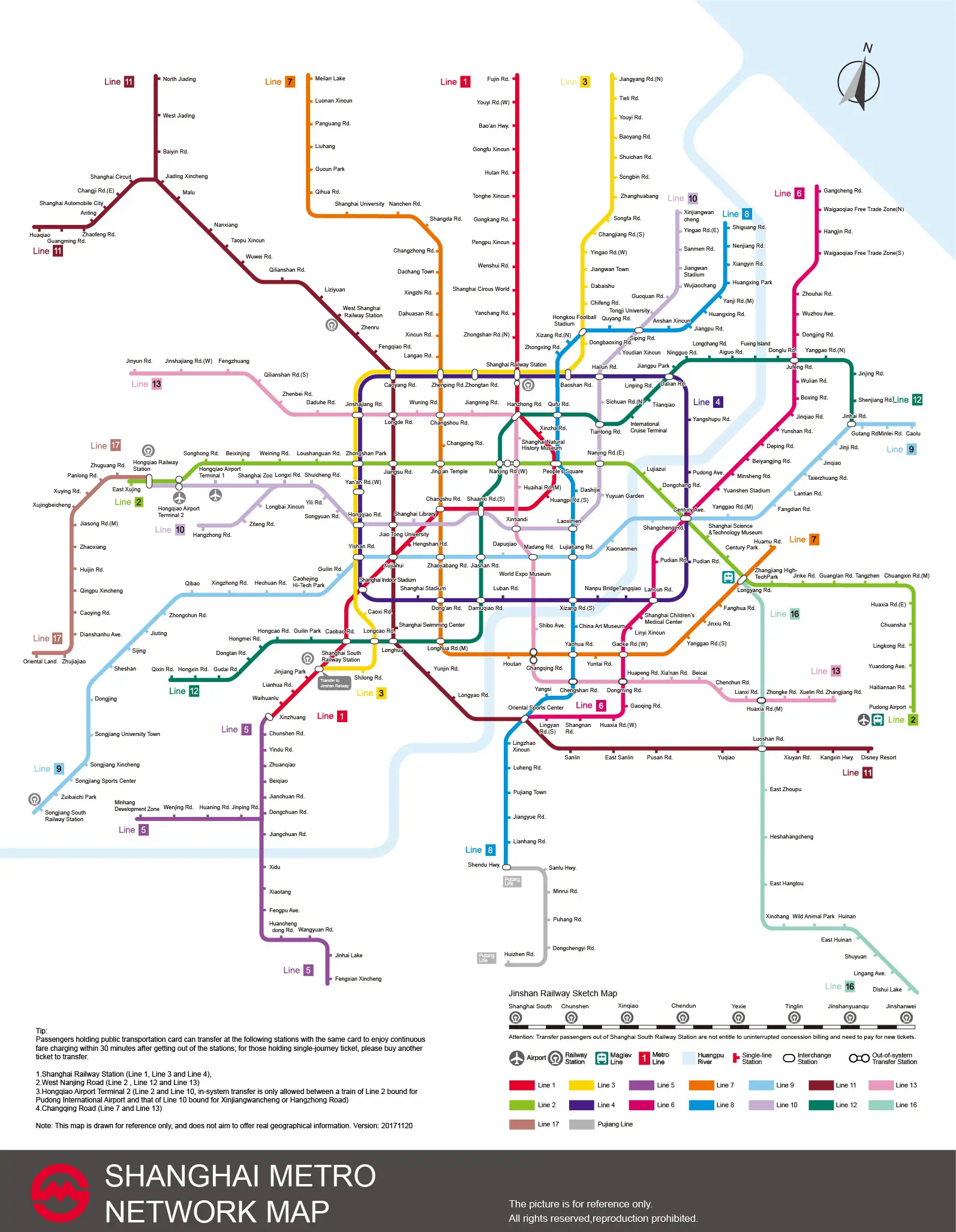

Light rail is a lower-volume market in which many cities suffer from severe passenger capacity limitations. Indeed, an iconic image of Asian city life shows professional ‘packers’ pushing passengers into subway cars to increase capacity (*). Instead, it would be much preferable to safely pack more subway trains into the existing subway track infrastructure than to try to create the perfect ‘human sardine can’ subway car.

To allow cities to pack more subway trains into the same track infrastructure, reliable automated anti-collison systems can be critical to prevent trains from colliding with each other. To serve this market, AWEARE can leverage its simplicity of integration, which facilitates collaboration with partners to pursue lower volume verticals such as light rail, trucking and robotics. Instead of licensing, the algorithms, software, and hardware keys can be bundled with third-party components including processors, A.I., and other sensors to provide a total solution.

Our Shanghai-based partner, MRD,.provided a letter of interest (available in website). MRD forecasted sales may start within 36 months after meeting specifications for false positives, range, and frame rate. Initial sales may comprise non-recurring engineering (NRE) and a small scale deployment, with the Shanghai Metro system being an ideal customer.

https://www.thatsmags.com/china/post/5637/how-to-catch-a-train-in-china-video-going-viral-clearly-taken-in-japan

Shanghai Metro system

Depending on customer preference, radars can be deployed in the front and rear of each subway train and/or both directions in each station of each subway line. The roll-out plan assumes dozens of units per year (or one small line of deployment) in years 3 and 4 as validation platforms before wider adoption can occur.

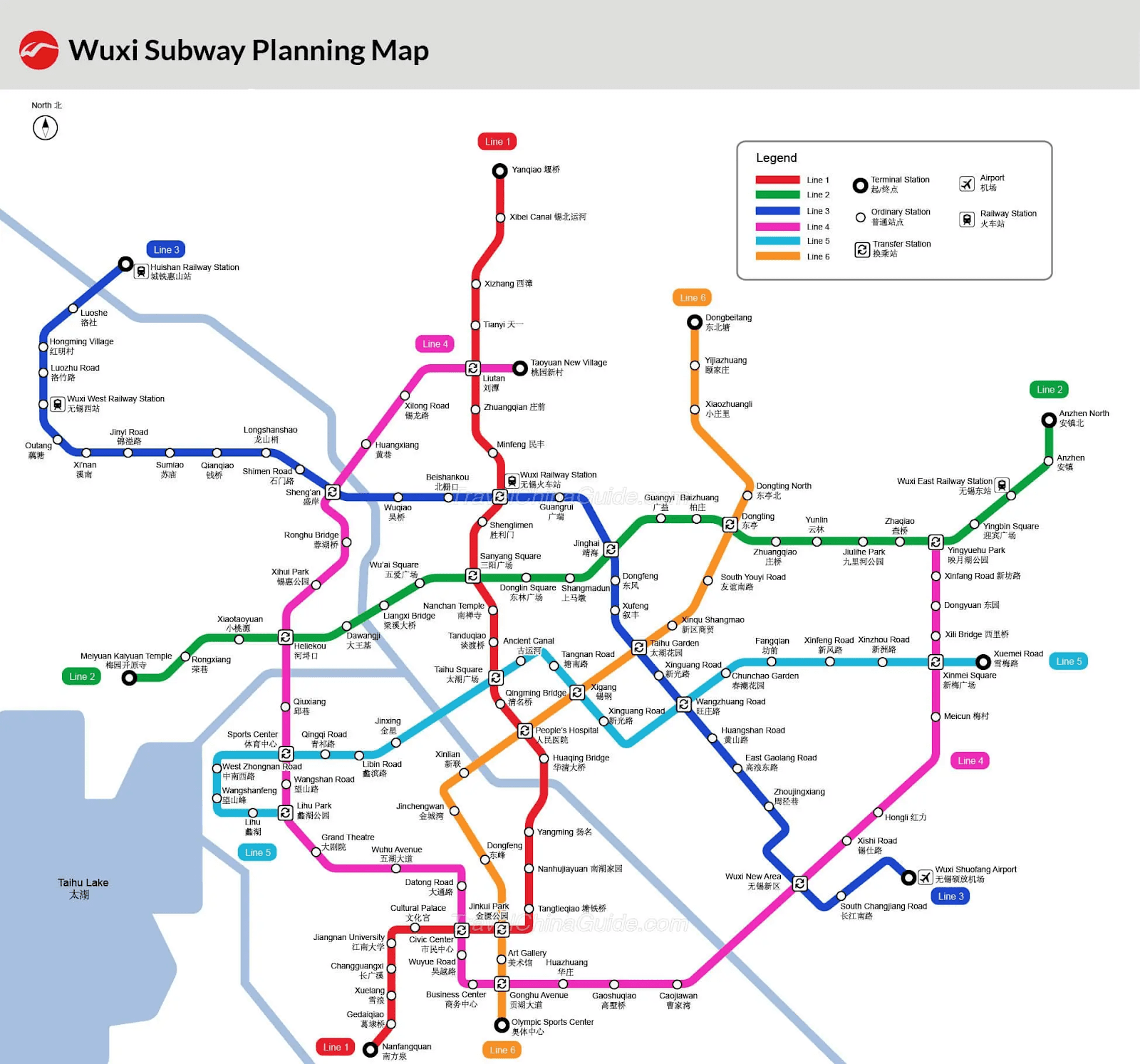

Wuxi Metro

While large metro systems represent the largest potential market, newer subway systems such as the Wuxi Metro system may offer timely opportunities with rapid growth and four new lines presently under construction.

AWEARE radar emerges as an unique promising solution to these industry challenges. Built on proprietary algorithms and waveforms protected by patents and trade secrets, AWEARE radar increases range/velocity resolution by 2x to 3x while eliminating over 80% of ghosts.

Eliminate over 80% of ghosts

AWEARE's unique algorithms and waveforms eliminate numerous type of false positives are eliminated beyond the case of radars interfering with each other. The ghost reduction milestone was witnessed by 3 independent experts from 2 leading American universities. A reduced false positive rate is crucial for mitigating issues like phantom braking and accurate detection of stationary objects. The commitment to ongoing innovation continues with AWEARE's immediate plans to add complementary algorithms that could further improve resolution and reduce the false positive rate, possibly exceeding 95% and realizing a truly reliable sensor.

2 to 3 times increased Resolution

Compared to other industry-standard frequency-modulated continuous wave (FMCW) automotive radar, AWEARE technology significantly improves range/velocity resolution. The increased resolution milestone was witnessed by 3 independent experts from 2 leading American universities. The importance of improved resolution cannot be overstated. A well known challenge is the need to differentiate between highway overpasses and large vehicles as illustrated in the figure. AWEARE radar’s resolution actually exceeds experimentally perceived performance limitations of automotive radar technology.

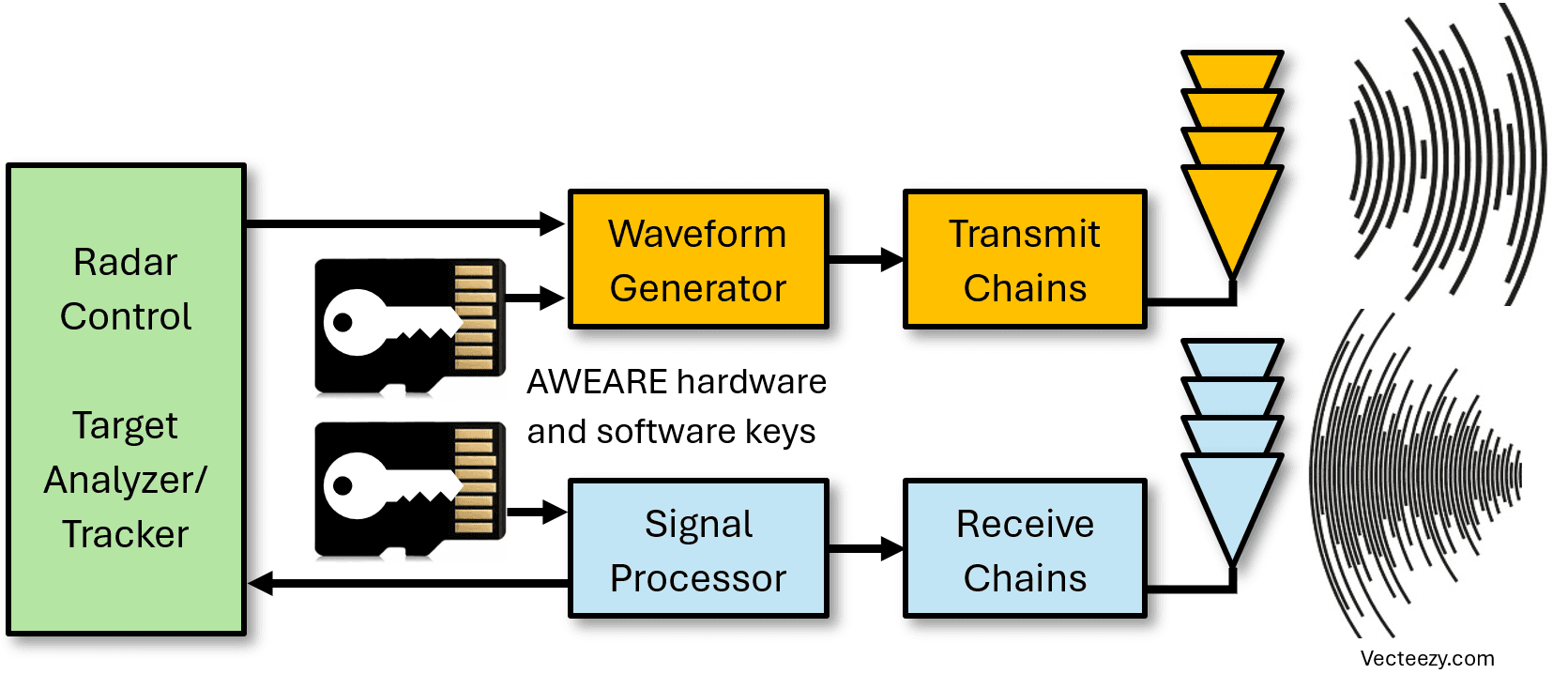

Hardware Signal Processing Keys

To facilitate specific implementations, hardware signal processing keys are designed for insertion into customer system to provide turnkey performance improvement while securing AWEARE IP.

The keys are interconnected with the control section as well as with the transmit generation and receive signal processing circuitry to permit the AWEARE waveform and algorithms to function.

How does AWEARE achieved a 2 to 3x better resolution?

Which commercial applications will Aweare target?

How can AWEARE reduce up to 80% ghosts?

Is AWEARE complementary to existing Radar Hardware?

Are you able to forgo the need for expensive LiDAR sensors?

Why is radar necessary with expensive high-performance LiDARs.

Why has no one else solved the radar problem?

What is AWEARE advantage for mining and agriculture?

How does a radar work?

Who has already committed funds, and what is their level of engagement or influence in the company?

Are any strategic investors or industry experts backing this project? What role will they play in guiding the company's growth?

Who is acting as the trustee, and do they have a strong reputation or a history of successful projects in this industry?

Why does AWEARE use blockchain and digital wallets for this fundraiser instead of more traditional investment channels? Is this method primarily for transparency, technological alignment, or other reasons?

How accessible is this blockchain-based investment process for traditional investors, and what support does AWEARE offer for those unfamiliar with digital wallets?

Is there a clear path for investor liquidity in the future, and what options will exist for investors who want to exit?

Are there concrete plans or milestones for listing on regulated exchanges or creating secondary markets for the tokens?

Given the competitive landscape, what unique factors position AWEARE Global to outperform existing radar solutions in the autonomous vehicle market?

What key strategic partnerships or licensing agreements are in place or being pursued to ensure widespread adoption of AWEARE’s radar technology?

The prospectus mentions aggressive pricing below industry norms. How does the pricing strategy support long-term sustainability, particularly given potential high R&D costs and licensing expenses?

Are there plans for significant software updates or additional features that could make the technology adaptable to sectors beyond automotive, such as rail, robotics, and security?

What safeguards are in place to protect AWEARE’s technology from replication, particularly with the use of common industry chipsets?

What key challenges in the light rail industry does AWEARE's radar technology address, and how does it outperform existing solutions?

Are there specific customer demands or regulations that are driving interest in advanced radar systems for light rail?

Does AWEARE have any partnerships or ongoing discussions with light rail operators or transit authorities? If so, what progress has been made?

Are there plans to leverage data from light rail deployments to enhance product features, such as predictive maintenance or real-time analytics for safety?

What lessons or best practices from drone operations are relevant to the design and deployment of AWEARE’s radar technology?

How might AWEARE’s radar technology enhance autonomous or semi-autonomous navigation and collision avoidance for drones?

Given the challenges of drone navigation in varied weather conditions, how does AWEARE’s radar outperform other sensor options like LiDAR or cameras?

Is AWEARE exploring partnerships with drone manufacturers to facilitate easier integration of its radar systems?